Lectures from Dad and trendy TikTokers: influences on teenagers’ financial knowledge

At a time when the cost of living is referred to as a crisis, good financial decisions are more important than ever. In a recent study, Life Education Trust found parents have the biggest influence on teenagers’ knowledge of money matters, but teachers, other relatives and TikTok play a big role too.

In partnership with PMG Charitable Trust, the organisation investigated the spending habits, financial literacy and education preferences of the next generation of workers through a series of focus groups. Participants were aged between 14 and 17, from six different secondary schools across the country.

Influences

Teenagers participating in the focus groups were asked who they talked to about money. In every group, participants said they talked to their parents. Several teens said they talked to other family members including grandparents, older siblings and cousins.

“(my Dad) likes to explain everything that happens with money, sometimes it’s a bit boring.”

“Grandparents cos they’ve sort of lived through it all.”

Teachers, particularly Commerce or Financial Literacy teachers, were mentioned here and in other questions asked.

“Mr Smith tells us to use KiwiSaver, it's his favourite thing in the world.”

When asked about other sources of information about money, the teenagers ranked TikTok and Google the highest.

The level of scrutiny of information from these sources varied considerably.

“It's a good way to find out about new subjects that you can dive deeper into so you don’t necessarily need to trust what they say cos you can do further research.”

“If some random with a couple of followers says something I ain't gonna believe it, cos it looks like a scam.”

“(I would watch more of) The person who looked fashionable.”

‘How to make money’ or ‘get rich’ was the most common search topic, along with ‘how to save money’, the cost of things, earnings for specific jobs and in one case, stock trading charts.

Money worries

Most of the teenagers interviewed had thought seriously about their futures and wanted to support themselves and avoid getting into debt.

“Being broke,” was the most common worry. “Not being able to stand on your own two feet”, “Not having enough to have a good life”, and “No home” were also concerns.

Participants were also worried about what would happen if they had a lot of money, mentioning concerns about “Fake friends”, “Gold diggers”, “Losing friends” and “Getting too comfortable”.

Some were thinking beyond their own situation, considering support for their wider family, power and corruption. “A handful of people have most of the world’s money, have loads of power and control because they have so much money.”

Scamming was mentioned in most groups and while some participants thought older people were more susceptible to being scammed, others were concerned that scammers might “steal all my stuff”.

“Being scammed happens more times than you think.”

Work

30% of the participants had part-time jobs. It was clear that part-time jobs provide more than work experience. Teenagers who had paid work were often paying tax, had been given an opportunity to sign up/be signed up for KiwiSaver, had bank accounts, were more likely to be saving.

Some said they would ask their employer if they had questions about money.

Spending habits

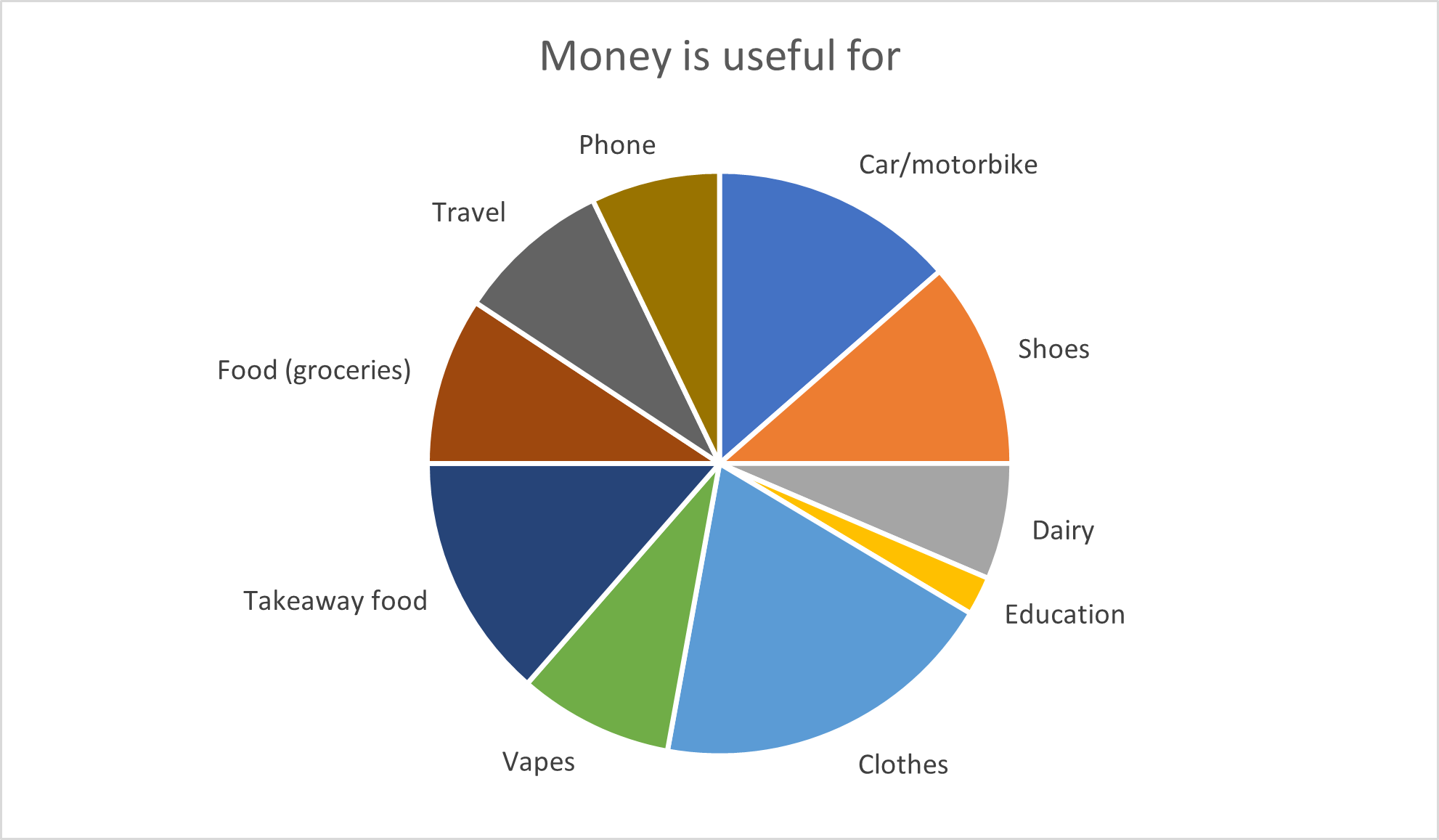

The most popular items to buy were clothes, shoes, cars/motorbikes, takeaway food, groceries and vapes. Cars/motorbikes were more popular choices in rural areas and comments reflected the independence they provided.

Saving

Nearly half the students participating said they saved regularly. Most of these students had savings accounts, although one mentioned a piggy bank. Some saved even if they didn’t have a regular income. Only 28% of the students had a KiwiSaver account and there were varying levels of understanding about it.

“Most people do it.”

“I'm confused as to how Kiwisaver works.”

Planning for the future

The participants were asked to identify what they thought money was useful for in the future. Housing was the most popular item, followed by transport and travel, “When you're older you just sometimes don’t want to stay in the same place, you want to go to other countries to explore the world”.

94% of the students asked thought they would own their own home one day.“It would be cool having a house”, “25/26, that’s a sweetspot age (to buy a house)”.

Many of the students’ comments showed they had considered the cost of retirement and what they wanted it to look like.

“When you're older you wanna retire sooner and you want to retire with someone you love.”

“So I don’t have to worry about it, I’m putting some money into KiwiSaver now”.

What they wanted to know

The teenagers interviewed wanted to know how to make money, and more about loans, mortgages, saving, bank accounts, insurance, investment and tax.

“How to make money easy.”

“When I have loans and I have to pay them off, how do I make the payments, do I need an account?”

“Simple definitions of stuff because sometimes it’s hard to find, like you can search it up or stuff but then the answers are like super complicated.”

“Insurance, how that all works. I’d want to have insurance on my house, in case something happens.”

The research findings will be used to inform further development of financial literacy education for Life Education Trust and PMG Charitable Trust.